Section 115E. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot.

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter.

. Power to transfer cases. More than one IRC section may apply to the same benefit. The Secretary of the Treasury shall establish expedited procedures for the refund of any overpayment of.

104188 title I 1202c3 Aug. Tax on investment income and long-term capital gains. Section 127 does not require.

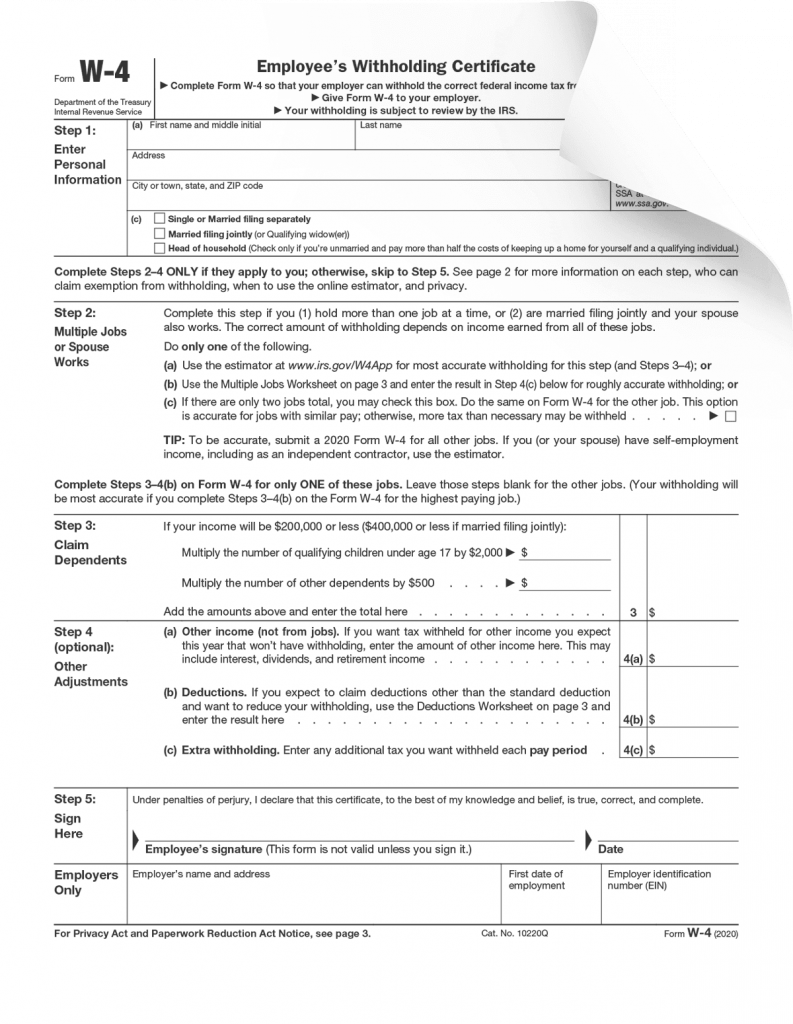

For example education expenses up to 5250 may be excluded from tax under IRC Section 127. Section 127 of the Income Tax Act A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. 1 Any person dissatisfied with any order passed by a Commissioner or a taxation officer under section 121 122 143 144 162 170.

Yet another development that took place after the search operation was that by an order dated 26062013 passed under Section 127 of the Act the Commissioner of Income Tax Central. 127 a 1 In General. Capital gains on transfer of foreign exchange assets not to be charged in certain.

Section 127 Income-tax Act 1961. The key provision of Section 127 allows employers to provide tax-free reimbursement up to 5250 for higher educational courses at the associate undergraduate. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief.

Section 127 of the Income Tax Act. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner. Allahabad HC lays down Conditions for Transferring a Case.

Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified. Tax Code Section 127. Appeal to the Commissioner Appeals-.

1271 For the purposes of sub-section 1 of section 282 the addresses including the address for electronic mail or electronic mail message to which a notice or summons or requisition or. Internal Revenue Code Section 127 was created by Congress in 1978 as a temporary expiring tax. Gross income of an employee does not include amounts paid or expenses incurred by the employer for educational assistance to the employee if the.

Power to transfer cases. Amounts for additional education. Any person who intentionally aids or abets or advises any other person to commit any offense under this Act shall be punished with half a punishment.

Section 115F. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter. Section 127 merely requires an assessee to be granted an opportunity of placing its submission in writing before the concerned officer.

127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal. 20 1996 110 Stat.

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

Fun Activities For Teaching Teens Financial Literacy Financial Literacy Teaching Teens Teaching

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

No Capital Gain If Development Got Cancelled And Possession Taken Back

State Income Tax Collection Per Capital Income Tax Income Tax

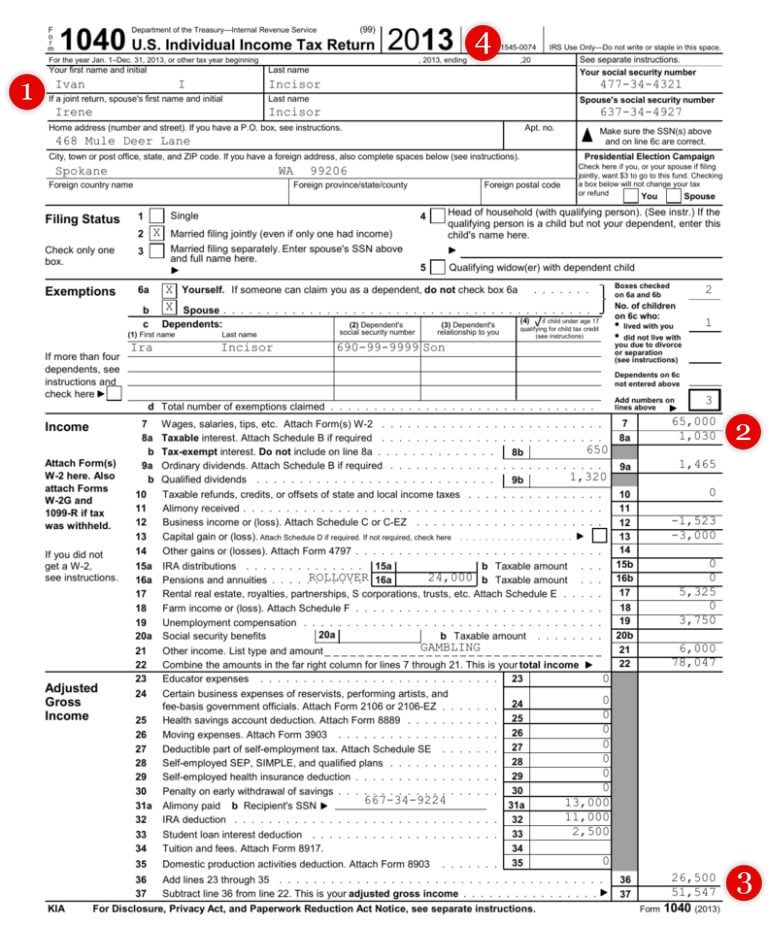

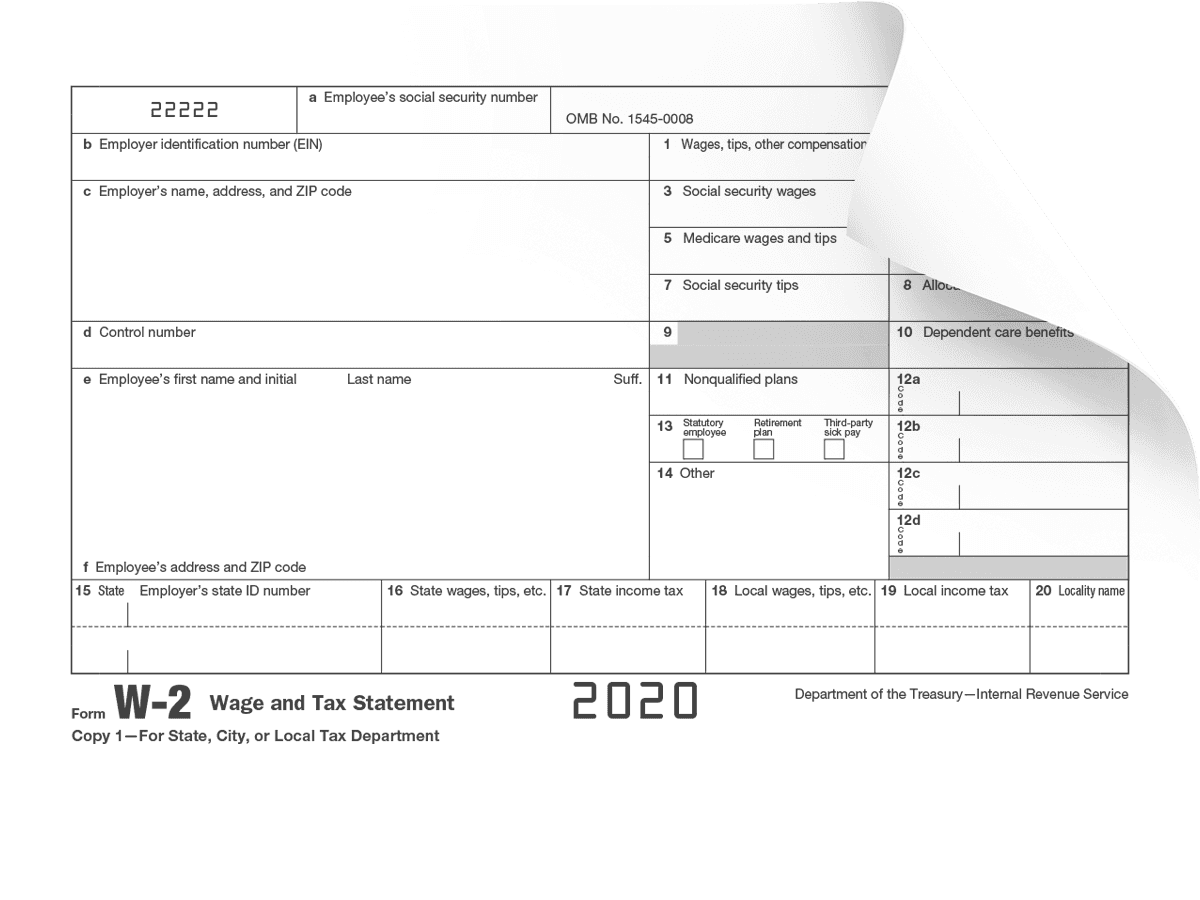

What You Need To Know About Proof Of Income Form Pros

Clarification Regarding Gst Rate On Laterals Parts Of Sprinklers Or Drip Irrigation System Drip Irrigation System Irrigation System Irrigation

3 224 Likes 12 Comments Mochi Studies On Instagram Holidays Aren T Holidays With Hand Lettering Worksheet Notes Inspiration School Organization Notes

10 Proof Of Income Documents Landlords Use To Verify Income

Pin By Jammalamadaka Venkata Subrahma On Jvsubrahmanyambcom24275 Income Tax Return Tax Return Income Tax

World S Largest Professional Network Budgeting Income Consumer Debt

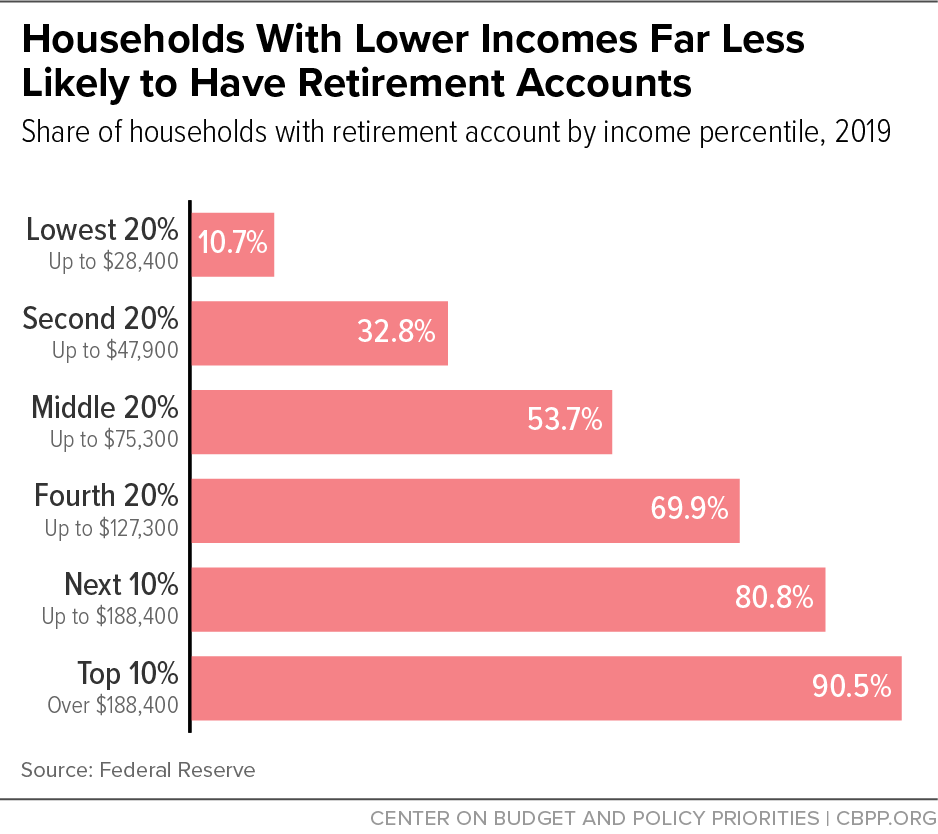

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska And Delawar Income Tax Tax Income

H R Block Tax Return Australia Sydney Branding Poster Design Graphic Illustratio Book And Magazine Design Identity Design Logo Social Media Design Inspiration

What You Need To Know About Proof Of Income Form Pros